Square Invoices

Free invoice templates

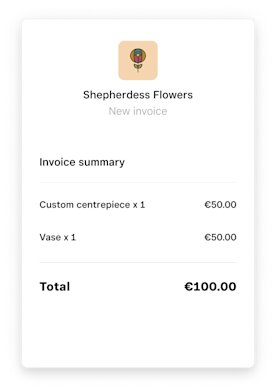

Make the right impression with custom, professional invoices that you can send to your customers in minutes.

Create a free customer-ready invoice in minutes.

Always look professional with our custom invoice templates. Once you download the template, it’s yours to customise any way you want. Fill in your business name, add your logo and send it to your customers when you’re ready.

Templates are just the beginning.

Square Invoices provides you with all the tools you need to send unlimited invoices, get paid fast and run your business, all from one place.

Send invoices over email, text message or with a shareable link from your phone or computer. Let your customers pay by card, Google Pay or Apple Pay.

That’s not all.

Whether your business is already established or you’re just starting out, Square Invoices has all the essential tools you need to get paid faster and streamline your workflow.

You’ll never have to sign a contract to use Square Invoices and our processing rates are always transparent. No hidden fees ever.

Hear what business owners like you are saying about Square Invoices.

‘Before using Square Invoices, our customers had to come in to pay in person. This could take days or even weeks. Square Invoices allows them to conveniently pay from anywhere, which helps us manage our cash flow.’

Koko Kinsale, Kinsale

Co. Cork

Invoices 101

Everything you need to know about finding the right invoice template for your business needs.

What is an invoice template?

An invoice template is a preset, customisable template that you can repeatedly use to invoice your customers. It is available in popular file formats like Word, Excel and PDF. A free invoice template makes your professional life easier by getting you paid much faster, saving you time and increasing your productivity.

Filling out your invoice

The type of information you include on your custom invoice gives your customers clear, actionable information on what to do to pay you faster. To ensure that you get paid efficiently, make sure you enter your project details and business and customer information accurately.

Features of an invoice template

Always appear professional by including:

-

Your business information

(name, logo, email address, phone number) -

Your customer’s information

(name, email address) -

The invoice number

-

Sent and due dates

-

Notes or payment terms

-

Itemised rows for your job description

-

Applicable tax and discount information

Which file format to use

Your printable invoice template is available in Word, Excel and Adobe Acrobat (PDF) formats. Which format is best depends on the situation for which you’re using it.

Word invoice template

Use a Microsoft Word template when your primary concern is having options in your invoice design process. Word is known for letting you design invoices, as well as various kinds of documents and reports. Customise your blank invoice template by adding vibrant images and tweaking its colours and fonts.

Excel invoice template

An Excel invoice template is ideal if you have many itemised rows of provided services, for which you need to automatically calculate totals. Thanks to Excel’s formulas, this process becomes a breeze.

PDF invoice template

Boost your professional reputation and trustworthiness by sending PDF invoices to your customers. This Portable Document Format lets you send invoices the way they were originally created, even after you convert them to PDF. PDFs are also highly secure. They can be password-protected, and each change to your invoice leaves an electronic footprint.

Start sending free invoices today.

Have questions about getting started? Connect with us ->

FAQ

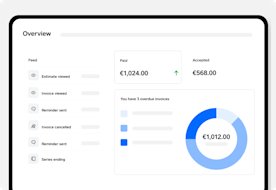

Square Invoices is all-in-one invoicing software that helps businesses request, track and manage their invoices, estimates and payments from one place. Our easy-to-use software will help your business get paid faster by letting you request, accept and record any type of payment method. The Square Invoices free plan has everything you need to send unlimited invoices, estimates and contracts, while the Square Invoices paid plan has time-saving tools for streamlining your work and billing needs. Compare plans on the pricing page.

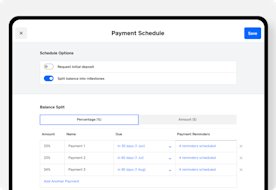

A manual invoice process, such as creating invoices with Microsoft Word or Microsoft Excel, can be time-consuming and difficult to manage. E-invoicing lets your business automate invoice processing and save time by tracking key invoice data such as open invoices (also known as outstanding invoices). It also helps you manage late payments more efficiently with payment reminders you can send your customers before an invoice due date.

Send your first invoice by signing up for a free Square Invoices account. Then set up recurring payments and auto-reminders. Finally, request deposits so you always get paid on time.

An electronic invoice is created with online invoice software or another cloud-based solution. It provides small business owners with professional digital invoices that can be paid online or in person. A paper-based invoice is written out manually – a process that requires extra time since tasks, such as invoice tracking and overdue invoices, aren’t automated.

You can accept all types of payment methods – cards, cash, cheques and eGift cards. Your customers can pay an online invoice in person or from their computers or mobile devices with a credit or debit card, Apple Pay or Google Pay.

Yes, Square Invoices offers integrations to the most popular accounting software providers, including Commerce Sync and Xero. With Square you can seamlessly import payments processed with Square Invoices to your accounting software for accurate record-keeping.

Square Invoices comes with easy-to-understand billing features that help you create recurring invoices. You can also save a card on file to set up auto-billing for any customer.

Yes, you can create recurring invoices by signing up for a free Square Invoices account. When your customers receive your invoices to their email account, they can then pay them online. Card on File payments are charged automatically. Depending on your payment transfer preferences, you could have the funds in your bank account as soon as the next working day.