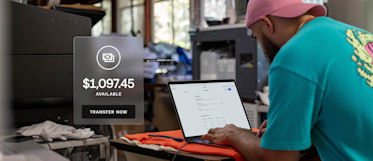

Transfer and access money at the speed of your business

Get your funds instantly, in 1-2 business days or on a custom close-of-day schedule — with little or no fees.

Move your money your way

See all the ways you can transfer your money with Square.

| Compare transfer options | Speed | Price |

|---|---|---|

| Standard | As soon as the next business day into an external bank account | Free |

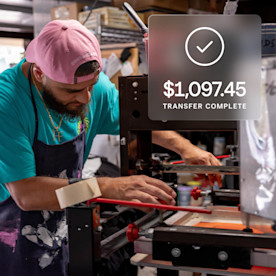

| Instant | Instantly on demand into an external bank account | 1.75% of amount |

| Same-day | Instantly into an external bank account on a customizable automated schedule | 1.75% of amount |

Total control of your cash flow

From customized close-of-day transfers and detailed activity and sales reports to robust business checking account features, our tools help you track, spend and move your money however you want.

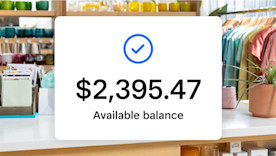

No waiting on transfers with Square Checking

Your Square sales flow directly into your Square Checking account and can be accessed immediately with your debit card or account and routing numbers — no more waiting.

All your questions, answered in one place

To transfer your money faster than one to two business days, you have several options: instant transfers and same-day transfers. Instant transfers are available to send your eligible balance on-demand, 24 hours a day, 7 days a week. Same-day transfers are available to automatically send your eligible funds to your linked bank account at your close of day. You can set same-day transfer as your preferred transfer option for any day of the week, and still trigger an instant transfer anytime you need funds on-demand.

Instant transfers have a minimum balance of $25 after Square’s fees, and a maximum transfer size of $10,000.

Same-day transfer has a minimum balance of $1 after Square’s fees, and a maximum individual transaction size limit of $10,000. If your balance exceeds $10,000 but does not include individual transactions greater than $10,000, you’ll receive multiple transfers from Square.

Funds that are not eligible for instant transfers or same-day transfer will be sent to the bank account linked to your Square account in one to two business days.

Note: Some new sellers start with a limit of one instant transfers per day of up to $2000 or one same-day transfer of up to $10,000. As you run and grow your business with Square, a higher daily transfer amount may become available.

Yes. With same-day transfer, you can schedule your funds to directly transfer to your linked bank account at your close of day on any day you choose. You can set up same-day transfers from your Dashboard.

Instant transfers send your funds instantly, even on nights and weekends, regardless of your regular transfer schedule.

Note: Any money not sent instantly will be sent to your linked bank account in one to two business days.

Your complete transfer history, along with any instant or same-day transfer fees, is available to view and download from Balance > Transfer Reports in your online Square Dashboard. Read more about viewing your transfer history.

You can also view instant and same-day transfer from the Square Point of Sale app by navigating to Balance > Transfer Reports

Small business, cash flow, and you

Don’t have an account with Square? Sign up today.

Instant and same-day transfer require a linked bank account or debit card and costs a fee per transfer. Funds are subject to your bank’s availability schedule. Minimum amount is $25 USD and maximum is $10,000 USD in a single transfer. New Square sellers may be limited to $2,000 per day.

Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard. Square Debit Card may be used wherever Mastercard is accepted.

Funds generated through Square’s payment processing services are generally available in the Square checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.