Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Priced to help you start, run and grow your business

Start for free and add tools as you need them, or explore our plans to get everything you need at once.

Plans for every stage

Free

Sell in person, online, over the phone or out in the field. No setup fees or monthly fees – only pay when you take a payment.

£0

/mo.

+ processing fees

Plus

Get advanced features designed specifically for restaurants, retailers or appointment-based businesses. Upgrade when you want to, cancel anytime.

£29+

/mo.

+ processing fees

Premium

Process over £200k a year? Build a bespoke plan that meets the complexity of your operations. Hardware and software discounts as well as custom processing rates may be available pending eligibility.

Custom

+ processing fees

Included with every Square account:

Fast online signup

Account takeover protection

Advanced reporting at no additional cost

Transfers as soon as the next day

End-to-end encrypted payments

Dispute management

Free Square Point of Sale apps

Active fraud prevention

Customer support

Tools to mix and match

Take payments in person, online, over the phone or out in the field – no training required.

Starting from £0/mo

Everything your restaurant needs for day-to-day service, including online ordering and POS.

Starting from £0/mo

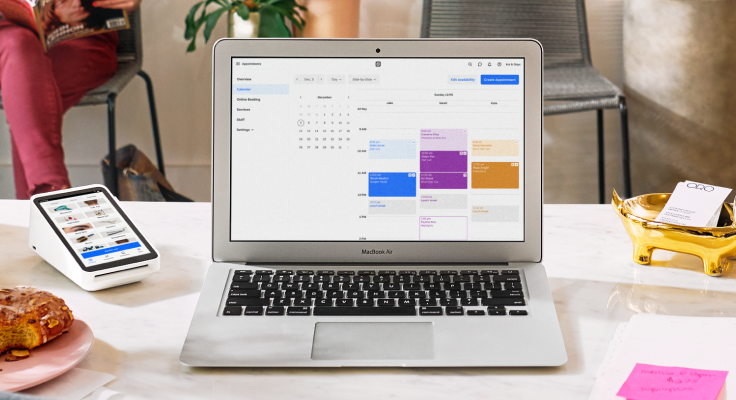

Online booking, automatic appointment reminders and more tools to keep you in charge of your time.

Starting from £0/mo

Sell in-store and online, manage inventory and offer in-store pickup or delivery to reach customers where they are.

Starting from £0/mo

Send digital invoices and estimates, accept payments, send reminders and track which invoices are paid.

Starting from £0/mo

Easily sell, take bookings and show off your services online. Plus, reach customers on Instagram and Facebook.

Starting from £0/mo

Turn your computer into a card terminal to offer remote billing and take card payments over the phone.

Starting from £0/mo

Create payment links, buy buttons or QR codes. Share them through social media, email, text or on your website.

Starting from £0/mo

Automatically create a customer profile with basic contact information each time you make a sale.

Starting from £0/mo

Become eligible for a loan up to £200k by processing payments on Square. Get funds as soon as the next day.1,2

No interest — just one flat fee.

Get your funds transferred to your bank account instantly, the moment you make a sale.1,3

1.5% fee

Bring in new customers with custom digital or physical gift cards.

Starting from £0/mo

Create, send and track email marketing campaigns in minutes.

Starting from £9/mo

Keep customers coming back with an easy to use rewards programme.

Starting from £25/mo

Streamline workforce management. Track your team’s time, schedule shifts, analyse labour costs and automate tip tracking.

Starting from £0/mo

Upgrading to Advanced Access gives you access to more advanced tools, such as custom permissions, team member badges, reporting with employee attribution and more.

Starting from £20/mo/location

An efficient kitchen display system you can rely on. Organise and fulfil orders from anywhere, in one affordable solution.

Starting from £15 per device, per month

Let customers pay in instalments, while you get paid in full with Clearpay. More options for them. More sales for you.

6% + 30p per transaction

Use the free iOS app to take and edit high-quality product photography and remove image backgrounds to sell online.

No fees

Accept contactless cards, Apple Pay and other digital wallets in person with Tap to Pay on iPhone. Available on iPhone XS or above running the latest version of iOS.

Tap and go. It’s that easy.

Accept contactless cards, Apple Pay, Google Pay and other digital wallets. Available on compatible Android devices.

Tap and go. It’s that easy.

Processing fees

In person

Take any contactless, mobile or chip and PIN payment at the counter or on the go.

1.75% per transaction

Online

When a customer makes a purchase through your Online Store, Online Checkout, eCommerce API.

1.4% + 25p for transactions with UK cards

2.5% + 25p for transactions with non-UK cards

Manually entered

When you manually key in your customer’s card details or use a card on file.

2.5% per transaction

Invoices

Let customers pay invoices online, in person or from their phone with a card, Apple Pay, Google Pay or BACS bank transfer.

2.5% per transaction

Plans by business type

Restaurants

Run your restaurant more efficiently. Use menus and table management for front of house, and kitchen displays and delivery for back of house.

Advanced POS features

Square KDS (unlimited devices)

Square Advanced Access

Appointments

Stay a step ahead of schedule – whether you run a salon or a construction business – with easy online booking, automatic appointment reminders and staff management tools.

Customisable online booking site

Automated appointment reminders

Square Advanced Access

Retail

All the retail tools you need for selling online and in-store, like inventory management, returns and exchanges, and reports.

Advanced inventory tools

Advanced retail reports

Square Advanced Access

Flexible hardware solutions

£599 + VAT or £50 + VAT/mo for 12 months1,4

£599 £449.25 + VAT or £47.43 + VAT/mo for 12 months¹ with code FRIDAY25 until 3 December.⁵

£99 + VAT or £17 + VAT/mo for 6 months1,4

£99 £74.25 + VAT or £12.37 + VAT/mo over 12 months¹ with code FRIDAY25 until 3 December.⁵

£149 + VAT or £25 + VAT/mo for 6 months1,4

£149 £111.75 + VAT or £18.62 + VAT/mo for 12 months¹ with code FRIDAY25 until 3 December.⁵

£99 + VAT or £17 + VAT/mo for 6 months1,4

£99 £74.25 + VAT or £12.37 + VAT/mo for 6 months¹ with code FRIDAY25 until 3 December.⁵

FAQs

-

Square’s pricing is simple and transparent. You will pay one simple rate for every contactless or chip and PIN payment based on the payment method you choose. That’s it. There are no additional fees or lock-in contracts.

-

Yes. You can upgrade, downgrade or cancel your plan at any time.

-

With Square Transfers, you can send your money to an external bank account in one to two working days for free or instantly for a fee.

-

Square works with any UK-issued and most international contactless, chip and PIN and magnetic stripe cards with a Visa, MasterCard, American Express, Maestro, Visa Electron, V Pay or Discover logo.

-

No, we have an array of tools to help you run your business that do not require you to purchase Square hardware, including Tap to Pay. Tap to Pay streamlines payments so you can sell anywhere in the United Kingdom. If you have an internet connection and an iPhone or Android, you’re in business.

-

Square has the tools that connect every side of your business. Discover the best business software solutions for your unique needs.

Start selling with Square.

Set up is fast and secure.

1Squareup Europe Ltd. is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (registered reference no 900846) for the issuing of electronic money and provision of payment services. Squareup Europe Ltd. offers both regulated and unregulated products. Square Loans offered by Squareup Europe Ltd. are not regulated by the Financial Conduct Authority.

2All loans are issued by Squareup Europe Ltd., registered in England and Wales (no. 08957689), 6th Floor, One London Wall, London, EC2Y 5EB. Actual fee depends upon payment card processing history, loan amount and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Offer eligibility is not guaranteed. All loans are subject to approval. Terms and conditions apply.

3Funds are subject to your bank’s availability schedule, but are generally available in your bank account within 20 minutes of initiating an instant transfer. Minimum amount is £15 and maximum transfer limit is £3,500 per day.

4All payment plans are issued by Squareup International Ltd. Plans available for purchase amounts from £29 to £3,000. All plans are interest-free. First instalment payment will be due at checkout. VAT will be calculated at checkout but billed with each instalment payment. Available plan lengths vary from 3, 6 and/or 12 instalments based on purchase amount. All plans subject to credit approval.