Please update your browser.

Download the latest version of a supported browser below to get the most out of this website:

Square for Recreation Level up with smart recreation software

Simplify operations, amplify experiences

Offer seamless payment solutions

Manage food and drink orders, merchandise, and booking sales — all from one place.

Take payments at the counter or tableside with powerful, easy-to-use hardware.

Accept all major payments, even offline1 when the internet is down.

Offer flexible payment options for deposits and final balances for group events and party bookings with Square Invoices.

Get discovered and manage bookings

Create your website with Square Online to showcase all the activities and experiences you offer.

Stand out from competitors and tailor your online presence to reflect your unique brand, logo, and colors.

Let customers book online instantly with Square Appointments.

Reduce no-shows and lost revenue with customizable policies, fees, and prepayment options.

Turn customers into regulars

Offer deals and loyalty points to keep your customers coming back for more.

Tailor customer experiences based on auto-generated guest profiles that track preferences, booking history, birthdays, and more with built-in CRM.

Promote new activities, seasonal deals, and events, and collect Google Reviews with automated text and email campaigns.

Sell physical or digital gift cards, enabling customers to gift your experiences.

Streamline behind-the-scenes work

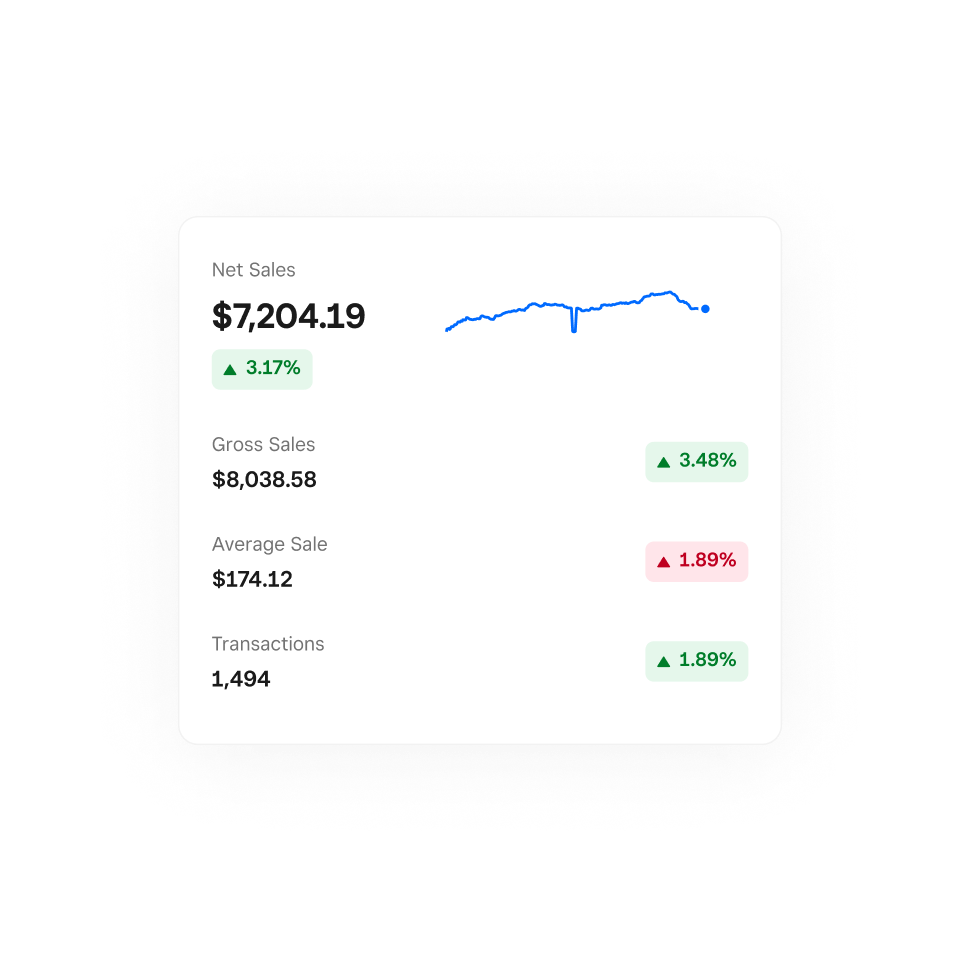

Make informed business decisions by tracking sales, bookings, and customer behavior with detailed reports.

Stay updated on your inventory and ahead of customer demands with low-stock alerts.

Create custom permissions for team members, manage schedules, and handle payroll from one dashboard.

Manage your cash flow and access funds instantly with Square Banking.2

“Square is essential to our business. Its flexibility and powerful APIs make it a leader in the point-of-sale space, helping us navigate a complex business environment.”

Mark Stutzman

AREA15

Las Vegas, NV

More tools to streamline your workflow

Gain valuable insights

Make informed business decisions by tracking sales, bookings, and customer behavior with detailed reports.

Expand your reach

Create a free website and let customers easily book activities and experiences online.

Sync all your apps

Integrate your favorite apps for eCommerce, marketing, ticketing, and events to automate tasks and save time.

Plans to fit every business

Free

The basics to run your own business while staying ahead of schedule

$0/month

for a single location + processing fees

Top features:

Unlimited staff accounts

Custom booking website and social media integrations

Integrated payments

Automatic text and email reminders

Automated contracts

Plus

Most popular

More advanced features for growing teams that offer top-notch service

$29/month

per location + processing fees

Top features:

Everything in Square Appointments Free

Customer confirmation texts and emails

Cancellation policy and fees

Waitlist

Appointment reports

Premium

A complete plan that meets complex booking and staff management needs

$69/month

per location + processing fees

Top features:

Everything in Square Appointments Plus

Advanced Access

Select scheduling features from Square Staff

Resource management

Custom staff commissions

Custom contract fields

Hardware that works wherever you do

Expert tips, tools, and trends

Ready to grow your business?

FAQ

What can Square offer my leisure business?

Square has powerful software for bowling alleys, arcades, pool halls, escape rooms, and axe-throwing bars. The technology manages all sides of your business. Our products can help you streamline operations, manage your bookings, let customers book online, and more to keep your business growing.

How can Square booking software help improve my business operations?

Square booking software offers easy-to-use tools for managing customer bookings, accepting payments in person and online, and seeing all your data in one place. Customers can book online, even when you’re not working. Our software also protects your time with late cancellation fees and prepayment protection.

How can Square help with managing my team?

Our scheduling software can help you create team schedules, assign shifts, and see your teams’ availability so you can spend more time running your business and serving your customers.

Can I use Square software with other business platforms?

Yes. Square easily integrates with many popular business platforms, such as Constant Contact, Acuity Scheduling, Simple Tix, Noble, and more. Check out the full list on our Square App Marketplace.

Does Square offer ways for businesses to track their performance?

Square provides leisure and entertainment businesses with in-depth reporting that gives a 360-degree view of business performance, such as number of bookings, sales, frequent customers, and valuable insights that help you make informed business decisions.

1Offline payments are processed automatically when you reconnect your device to the internet and will be declined if you do not reconnect to the internet within 24 hours of taking your first offline payment. By enabling offline payments, you are responsible for any expired, declined, or disputed payments accepted while offline. Square is unable to provide customer contact information for payments declined while offline. Offline payments are not supported on Square Reader for contactless and chip (1st generation, v1 and v2). Learn more about how to enable and use offline payments here.

2Square, the Square logo, Square Financial Services, Square Capital, and others are trademarks of Block, Inc. and/or its subsidiaries. Square Financial Services, Inc. is a wholly owned subsidiary of Square, Inc.

All loans and Savings accounts are issued by Square Financial Services, Inc., a Utah-Chartered Industrial Bank. Member FDIC. Actual fee depends upon payment card processing history, loan amount, and other eligibility factors. A minimum payment of 1/18th of the initial loan balance is required every 60 days and full loan repayment is required within 18 months. Loan eligibility is not guaranteed. All loans are subject to credit approval.

Savings accounts are provided by Square Financial Services, Inc. Member FDIC. Accrue annual percentage yield (APY) of 1.00% per folder on folder balances over $10. APY subject to change, current as of 2/18/2025. No minimum deposit is required to open an account. Accounts will not be charged monthly fees. Accounts are FDIC-insured up to $2,500,000. Pending balances are not subject to FDIC insurance.

Square Checking is provided by Sutton Bank, Member FDIC. Square Debit Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Mastercard International Incorporated, and may be used wherever Mastercard is accepted. Accounts are FDIC-insured up to $250,000. Funds generated through Square payment processing services are generally available in the Square checking account balance immediately after a payment is processed. Fund availability times may vary due to technical issues.