Chers

comptables,

avocats,

consultants,

photographes,

professionnels,

We focus on the details,

so you can focus on clients.

We focus on the details, so you can focus on clients.

Square has built a suite of integrated tools to help save you time, so you can focus on growing revenue and delivering exceptional service to your clients.

Get paid faster.

Give your clients quick, easy and secure payment options in person and online.

Accept every kind of payment.

You can accept cash, cheques, credit cards, EFT payments (Electronic Funds Transfer), debit cards, gift cards, swipe or chip cards and contactless payments, including Apple Pay and Google Pay with Square payment solutions.

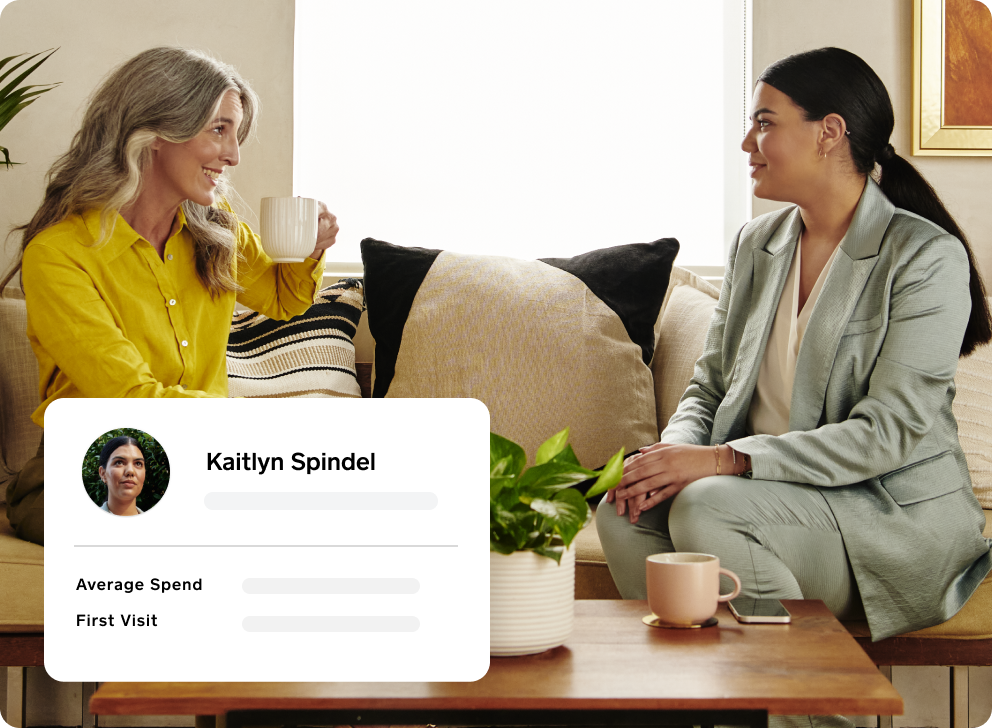

Deliver better client service.

Strengthen your client relationships with easy management tools.

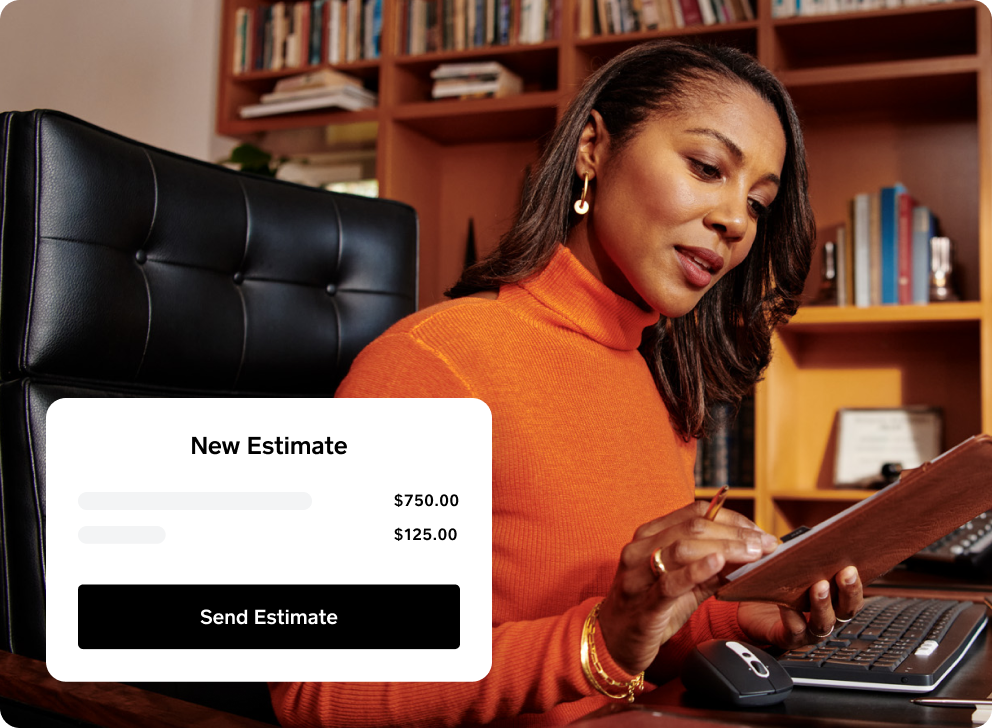

Align on scope and pricing up front.

Win more work by providing clients with a digital estimate they can approve with a click.

Schedule appointments easily.

Manage your availability, let customers book online and send automated reminders.

Get a 360-degree view of your customers.

Automatically track customer details and analyze purchase data with powerful customer management software.

Sign up for Square

Start accepting payments in minutes, there are no long-term commitments or subscription fees.

Need help getting started?

Contact Sales

Improve your cash flow.

Reduce operating costs and track business

performance with advanced reporting tools.

Make more informed business decisions.

Track earnings, learn what drives revenue and see real-time data with Square Analytics – all from Dashboard.

Access your cash quickly.

Get your money in your bank account the next business day (or instantly for a fee per transfer).

Spend less time chasing down payments.

Over 70% of Square Invoices get paid within a day.

Everything you need to streamline your workflow.

-

Win more work faster by offering options with multi-package estimates that auto-convert to invoices once accepted.

-

Protect your business by sending digital contracts with e-signature capability with every estimate or invoice.

-

Bill for work faster by creating, saving and re-using invoice templates.

-

Automate your billing by creating milestone-based payment schedules for longer projects.

Millions of big and small businesses rely on Square integrated solutions.

340M+

customers’ cards have been used to make a purchase with Square.

40M+

professional services invoices (and counting) have been sent.

280M+

appointments have been booked to date.

Square works with the third-party apps you already use.

Easily sync your accounting software, customer data and more with Square.

Get started with Square’s integrated suite of tools.

For help getting started, connect with us

See why businesses of all sizes succeed with Square.

Join our email list to learn how Square can help you take your business where you want it to go.

Nice to meet you.

We think businesses are as unique as the people who run them. Get individualized content on the topics you care about most by telling us a little more about yourself.

FAQ

Square works with professional service businesses of all shapes and sizes, from the self-employed and small business owners to multi-location firms. Some types of professional services companies using Square include accounting firms, consulting firms, mediators, architecture firms, interior and web design businesses, tax management firms, marketing firms and more. You can choose the payment solution strategy that’s right for your professional services business, customize your point of sale to get paid faster and do more business with stronger insights.

All of the Square tools seamlessly sync to cover everything your professional services business needs. From payment processing to customer management to advanced analytics, Square best-in-class products serve different parts of your business – all with one system. Our payment solutions work with other tools, like invoices, team management and more, to help grow your business, keep costs down, manage your cash flow and accept payments anywhere. Square also syncs with the small business accounting and bookkeeping software you already use, like Quickbooks and Xero.

With Square, your professional services company can offer whatever payment method works best for you and your customers. It’s easy to create professional invoices for online payments, accept credit card payments on-site with your POS system, take card-not-present payments on your computer and sync them all up seamlessly with your accounting software. Square cloud-based software works seamlessly with our card readers and other hardware for contactless in-person credit card transactions. Whether you run your professional services business in an office or the field, Square payment solutions work wherever you do. There are no long-term commitments or hidden fees – simply pay the processing fee per transaction.

The Square tools help small businesses like yours take care of payments and paperwork, all in one system. Our payment processing tools are packed with automated features that let you create recurring charges for repeat projects, schedule online invoices, track payments and create auto-reminders for clients. You can manage every transaction easily and ensure you’re paid on time. Square payment systems include quick payment processing to give you faster access to funds. With Square it’s easy to create a single, organized workflow with built-in payment schedules to keep every project on track. Square syncs across your devices, so whether you’re using a mobile app or web browser, you can run your business from anywhere.

Yes, Square works with the leading accounting software apps, syncing your sales with companies like QuickBooks or QuickBooks Online, Xero and many others that your small business or firm might use. For more information about compatible accounting software apps and accounting features made possible with Square, click here.

Square POS is free to use, whether you’re a small accounting firm, a services business or an enterprise business. People in all different industries use Square because it’s free to use, simple to get started with, provides flexible payment options and has all the tools small businesses need to run and grow. It’s also cloud-based, so you can access your information and manage your business from anywhere.