Getting paid on time is crucial to keep your cash flow healthy, no matter the size of your business. Having an invoicing system and process in place keeps your accounts organized and helps you get paid faster.

If you’re new to invoicing or looking to refresh your invoicing system, the first place to start is with the invoice itself — the most critical document in the process. Depending on the kind of business you run, your invoices should help you keep records of your projects, deadlines, cash in and cash out.

Get started with Square Invoices

Send online invoices from anywhere to get paid fast.

To save time and ensure that your invoices contain the right information and look professional, you should use a free template or online invoicing software like Square Invoices.

We’ve put together examples and tips for creating a number of different invoice types so you can customize templates to work for your business.

Basic blank invoice example

This first example shows what a basic invoice might look like. You can include whatever information will keep you organized, but at the very minimum, all invoices should have:

- An invoice number

- Your business’s name and contact information

- Your customer’s billing information

- A description of the goods or services rendered

- A due date (so you get paid on time)

- GST/HST, if applicable

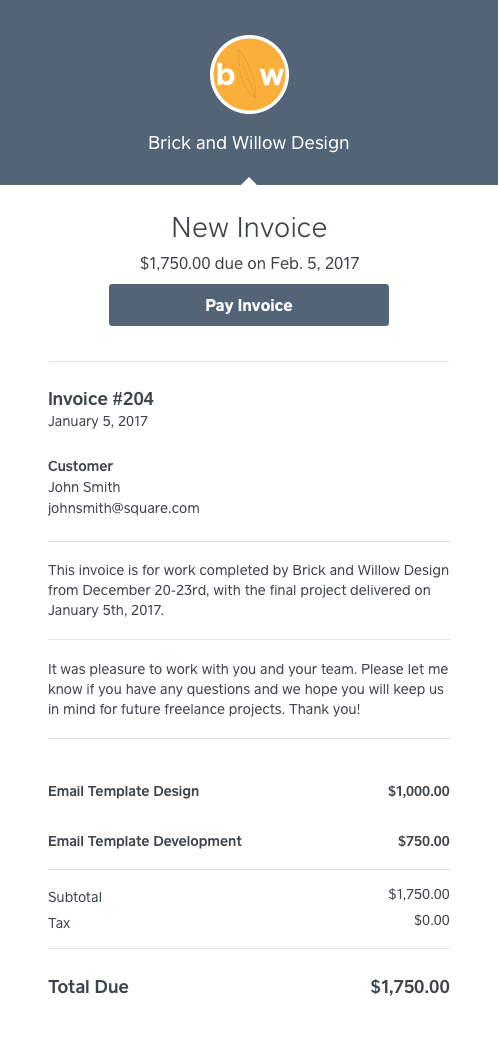

Example invoice for freelancers

In addition to the information above, freelancers should parse out specific details about the projects they’re working on. If you’re a freelancer, you should:

- Itemize your work by project or by hour (or both)

- Itemize any software or licensing fees you have incurred while working on your projects (for a designer, this might be font or image licensing)

- Consider adding a tip line if it’s customary to tip in your industry

- Make a clear note of when the client will receive the final work and what date(s) payment is due

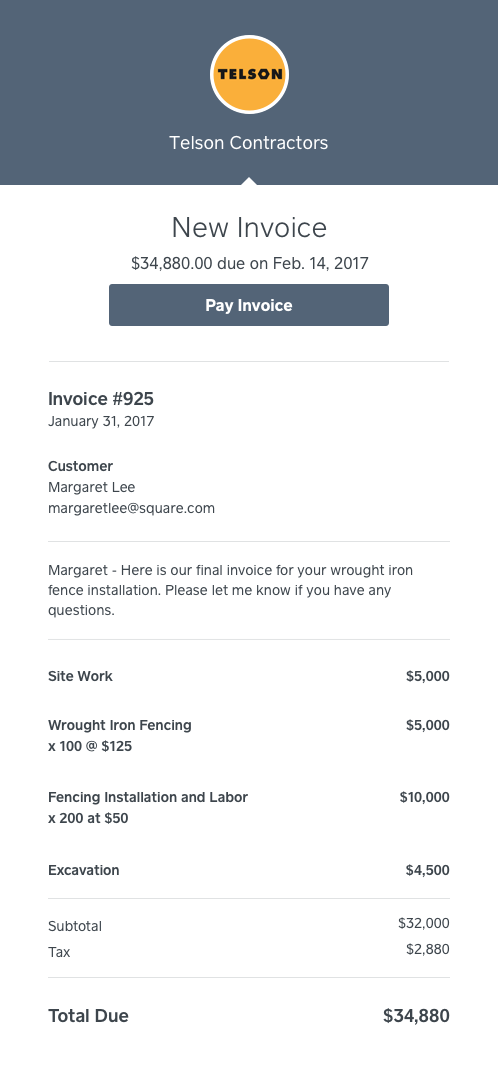

Example invoice for contractual work

Like freelance invoices, an invoice for contractual work needs to break down the specifics of the contract you’ve agreed to. So be sure to:

- Clearly itemize all the projects and tasks that you’ve agreed to

- Itemize the cost of any goods, tools, or licenses you use to complete the projects

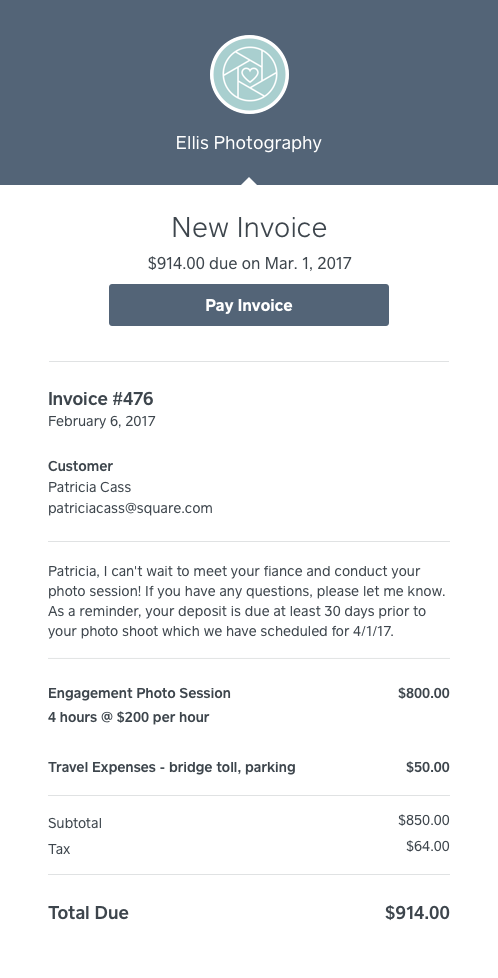

Example invoice for professional services

Service industries tend to have a lot of issues with chargebacks since it’s difficult to determine when a service was completed, or if it was satisfactorily done. Invoices can do a lot to combat chargebacks by:

- Displaying an hourly rate

- Clearly listing the date when the service will be delivered (if in the future) or the date when service was rendered (if in the past)

- Using the notes section to list terms and conditions

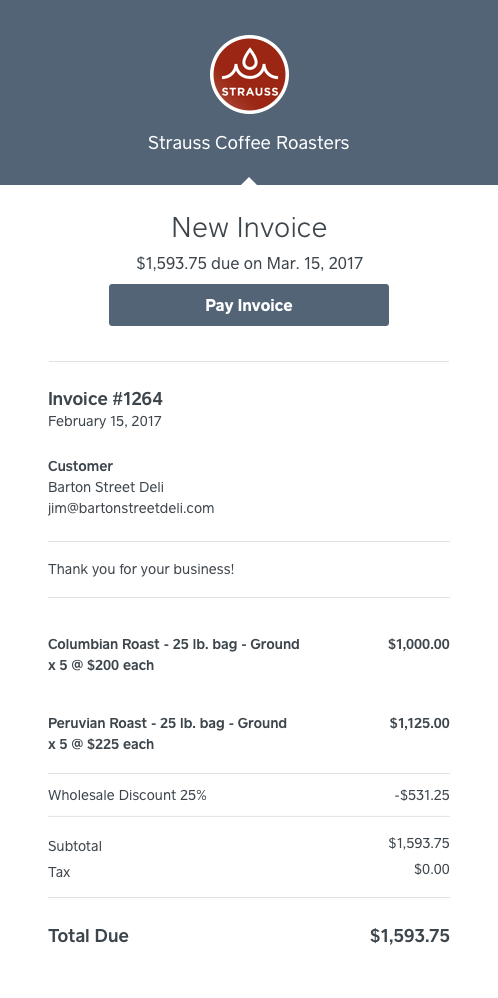

Wholesale invoicing example

If you have a wholesale business — for example, if you create beauty products that you sell to retail stores — an invoice catered to your business is important to keep track of your large transactions.

Wholesale invoices should include the regular price of your products, the wholesale discount, and the wholesale price your customer is being charged. A recent survey found that discounts and offers were cited as a top reason for brand loyalty, so showing the discount in your invoice is actually an effective marketing tactic.

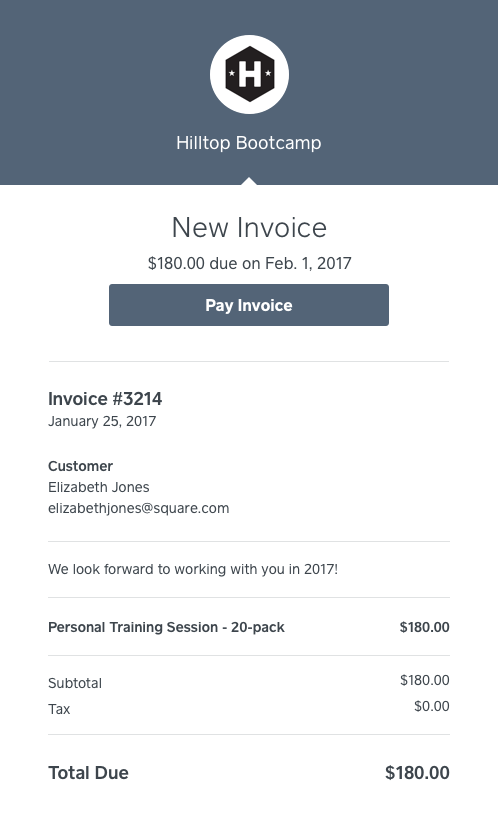

Lump sum invoice example

A lump sum invoice is used when you’re offering one rate for a number of products or services. Lump sum invoices are ideal for class packs at a yoga/fitness studio or flat rate projects.

If you are offering bulk deals for a large sum, make sure you clearly describe the package or lump sum in the itemized section. Also, be aware that many lump sum invoices have tax included, so there’s no need to add additional tax (as pictured here).

Remember, this post is for educational purposes only. For specific tax and accounting advice related to your business, consult a professional advisor.

Related Articles: